Ah banking, exciting stuff, right? I’ve recently found some enjoyment in simulating fee profiles, rewards, and payoffs of different strategies associated with banking and credit facilities. This is a simple blog based on my findings and recommendations, with some charts I coded up thrown in to spice things up. This is all part of a wider look into aspects of personal finance in South Africa, so expect some more content over the next few months.

In the first post I’ll briefly introduced this series. I’ll then get onto the more interesting stuff; how does one go about “abusing” the banks that try to abuse you?

This Series

- On Banking, Points & Rewards

- Retirement Annuities: Fee Hunting

- Coming Soon: Risk vs return and portfolio theory.

- Coming Soon: Arbitrage and uniqueness of South Africa’s FX situation

- Coming Soon: Changing tax rules.

- Coming Soon: Charlie Munger, diversification is for dummies

- Coming Soon: Alternative Asset Classes

The Real Value of Rewards

Reward points are untaxed - at least in South Africa. It’s hard to state how important this is.

If you consider the graft of point-maximisation as a side-hussle, your income is effectively not reduced by insert-your-tax-bracket.

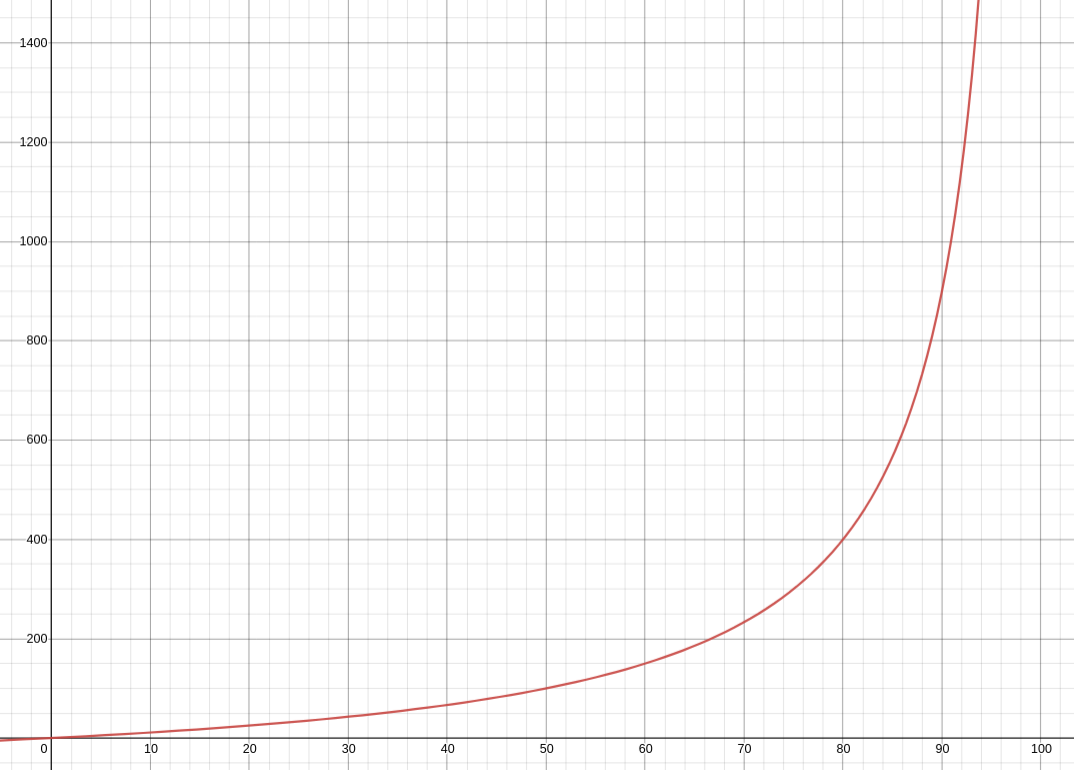

Let’s do the maths. First, let’s treat tax as a loss of income. We can then reduce the original capital by your tax bracket, say $x\%$. Then we have $100\%-x\%$ left after tax. To get back to $100\%$, we would need to make an asymmetric gain of $100\%+y\%$. In other words, given any tax-bracket $x$, we can figure out how much we’re “gaining” by not being taxed. We need to solve the following formula:

\[(1-x\%)(1+y\%) = 1\]This is actually a hyperbola. Plotting this makes it easy to read our results. Say our tax bracket is $50\%$. Then, as is logical, the graph shows we would need to make a $100\%$ gain to return to what we had before tax. More simply, if someone takes half of everything you have, you would need to double your remaining balance before getting back to where you started.

TLDR; here’s a list of my preferred strategies.

Basically, the Woolworths cards almost always makes sense. Pair this with a bank account and load up with another reward credit card depending on your needs and monthly spend.

- Firstly, to minimise banking fees, a good combination of rewards and simple banking is combining the Woolworths Gold or Black credit cards (depending on income) with Bank Zero. This would give you a minimum effective reward rate of 0.75% on Gold and 1% on Black. Total cost of R53/R69pm.

- An interesting strategy is combining Woolworths Black with FNB. By paying off your Woolworths card with your FNB card, you simultaneously fund your Woolies card while earning SmartSpend on FNB eBucks. Depending on your FNB account, this would be upwards of ~R280pm for an effective reward rate of between 1-5% - perhaps even a little more if you do a lot of shopping at Woolworths itself.

- Similarly, adding a Sanlam Money Saver card gives you 2.5% cashback. This is a useful addition to strategy 2 because there is no maximum on the Sanlam card, but FNB SmartSpend is capped. Good for big spenders.

- Assuming you can continuously pay off your Woolies card with a credit card, doing this with an AmEx Platinum could prove very rewarding. The effective reward rate could be well above 5%.

On Bank Accounts

Pretty much everyone will need a basic bank account. Determining what a bank account will actually cost you is no easy task. One has to consider the rewards and cashback you receive, costs for services such as EFTs, statement requests, and cash desposits/withdrawals. One fee that irks me is the international foreign currency conversion you’ll pay - especially important if you do lots of shopping overseas or travel a lot. Don’t think you aren’t paying these. Banks will often add a few percentage points (pips) to the current rate and claim they aren’t charging you a fee. Finally, you need to make sure the bank supports features you might need. For example, if you need to send and receive SWIFT payments, you’ll appreciate the features FNB or the other big banks provide. You won’t find this feature with Bank Zero, for example (at least for now). In summary, the main points I consider when looking at a bank account broadly fit into:

- Features

- Rewards

- Fees

- Service

Different people will value these points very differently, so no recommendation will come without ifs and buts. Regardless, I do think there are some obvious frontrunners one should consider. Just as a note, most of the major banks have far too many bank account variations. Most of them provide an “all-inclusive” bundle or package of sorts, which usually includes both a transactional and a credit (overdraft) facility on your main account, as well as a linked credit card. This is what I’ll focus on, otherwise comparing pricing becomes much more difficult. I also think its more appropriate to not have to worry about every hidden charge when you’re on a pay-as-you-bank system - especially since there are many good alternatives. In some cases, such as FNB, you’ll only earn at maximum reward rates if you have some credit facility linked to your main account.

Keep in mind, most of these packages have minimum or recommended incomes. These are usually just there for guidance and aren’t a hard rule. You’ll find most banks will try upsell you to their higher “tiers” of banking. Don’t be swayed by the branding - crunch the numbers and figure out what works for you.

Major Banks

FNB offers an enormous variety of account types. If you’re looking at creating a transactional relationship with a bank, FNB is a great option as they offer bundled accounts. There is, however, a complexity with understanding their fee profiles, which is why I recommend them only if you need access to a fully featured bank with great rewards and are willing to deal with some gamification of the banking system.

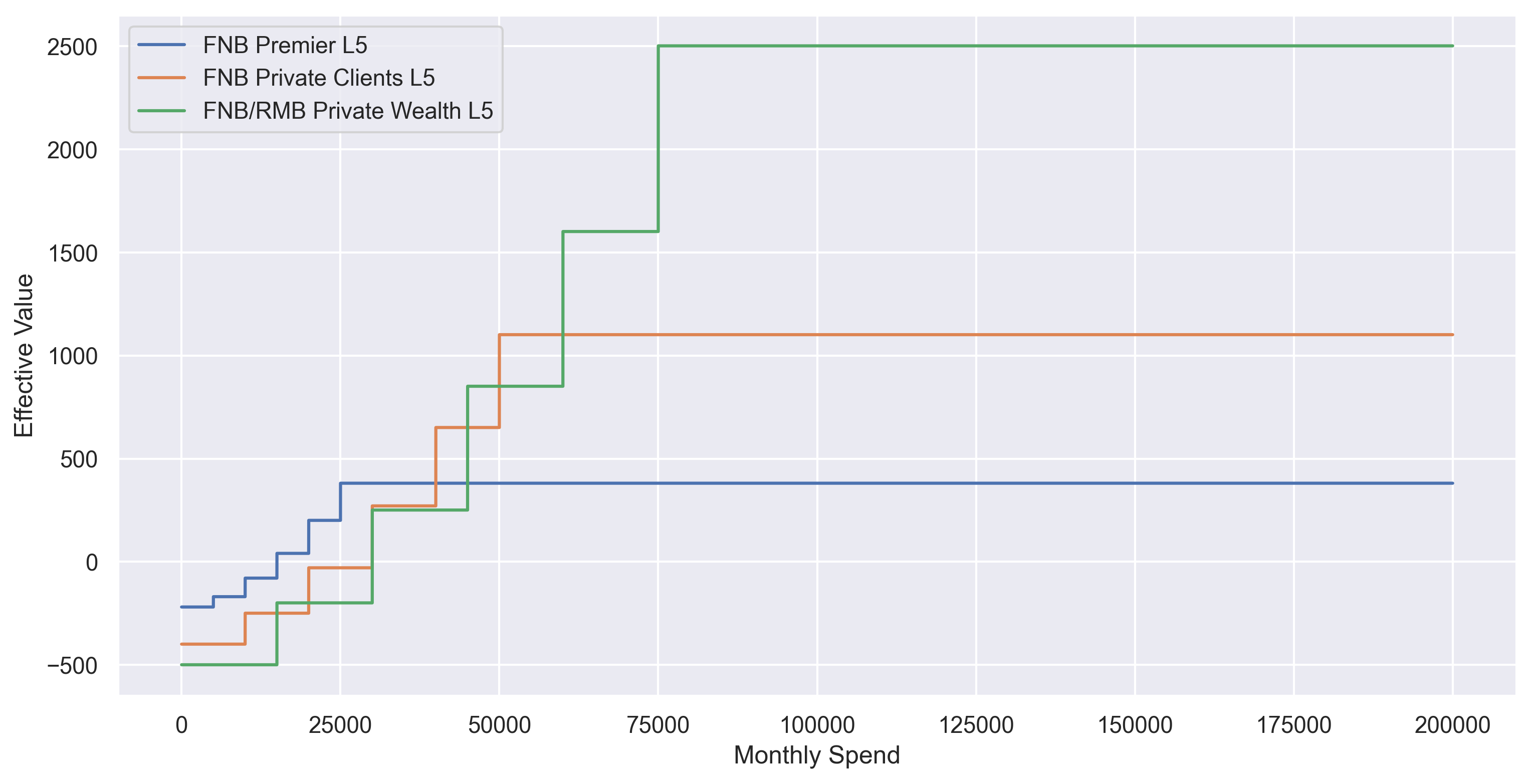

As of 2022, FNB’s eBucks programme is only really worthwhile if you are on FNB Fusion Premier, Private Clients, or FNB/RMB Private Wealth. One of these should serve as the bank account for most people. If you are doing any number of international transactions, such as working for an international company, FNB should definitely be a top consideration. They make automating the process of BoP forms easy - unlike Investec. Do yourself a favour and only deal with FNB in person/branch. Just don’t use their phone services unless you have a private banker - it’ll be good for your mental health.

In terms of rewards, they are unmatched by any of the other major banks. This is true mostly because it is very easy to actually attain them. 15% back at iStore, Checkers, Clicks and R4/litre at Engen are all achievable without much effort. There are caps on many of these rewards, but most people won’t reach these. Crucially, getting to the highest reward level is easy with FNB even if you don’t have a loan, insurance, or investments with them. I will note that they are gradually making it harder to get rewards each year, but at the moment they are still leading the pack. My recommendation is based mostly on (1) how much you spend each month, (2) whether you need/want a private banker, and (3) your monthly income. These scale as you’d expect, but here’s a table to show you the basic details.

| Account | Fee | Min. Income | Note |

|---|---|---|---|

| Fusion Aspire | R99 | R84k | eBucks value lowered. |

| Fusion Premier | R219 | R240k | “Young Professional” can access this. |

| Fusion Private Clients | R399 | R750k | It might make more sense to look at RMB. |

| Fusion Private Wealth | R499 | R750k / R1.8m | Min. income is lower on RMB Private. |

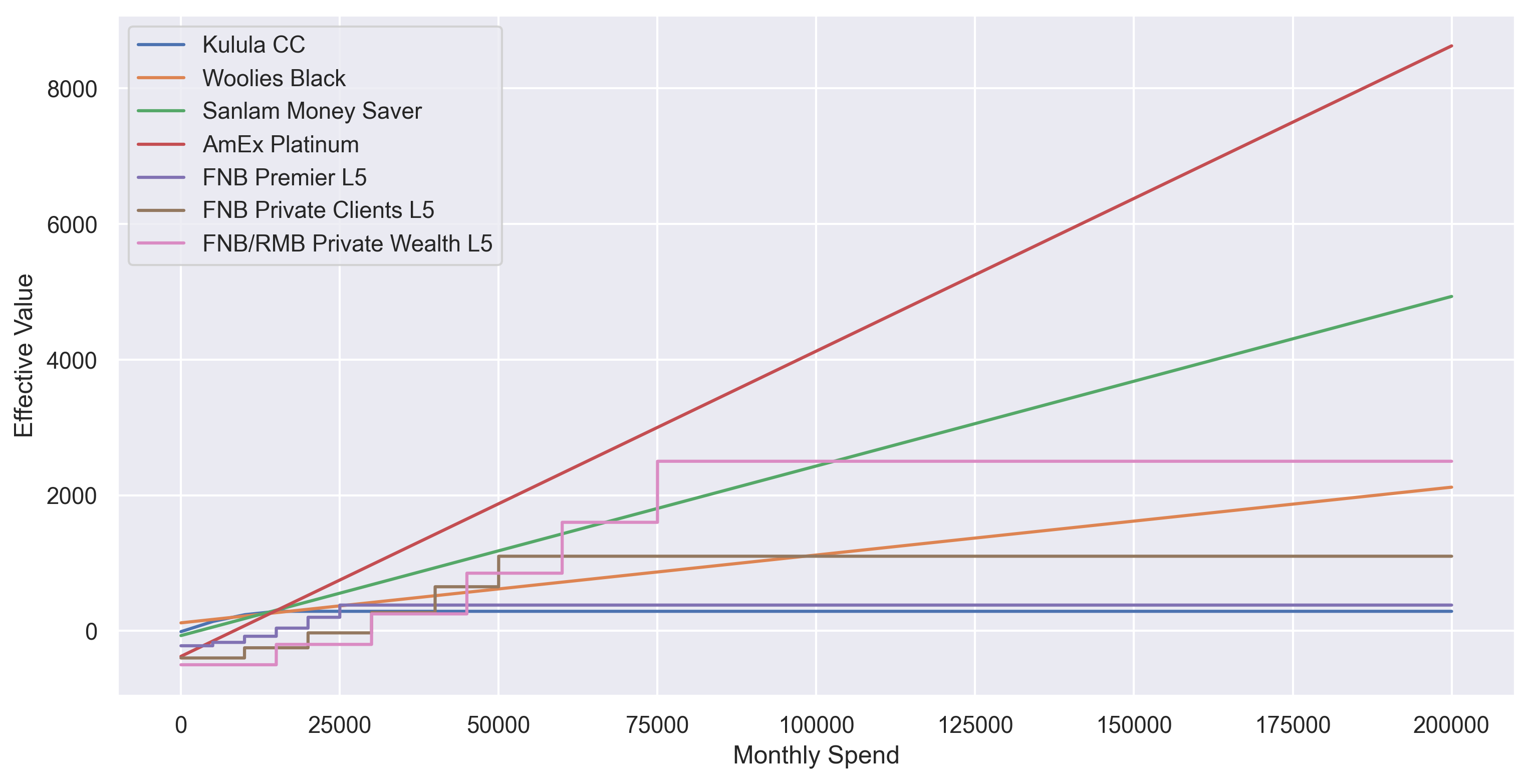

In terms of deciding what will work out in your favour, here’s a charts showing how much you’ll receive in value/rewards based on your eBucks Smart Spend (i.e. how much you are spending on your card) and an approximate value you’ll get in fuel rewards (from Engen) and Kauai vouchers, Clicks spend etc. The $x$-axis shows your monthly spend, while the $y$-axis shows your monthly value received. If you’re a movie goer, you’ll appreciate that you can buy discount vouchers (up to 40%) at NuMetro. It should be obvious that most people should stick to the Premier Fusion account and call it a day.

Standard Bank. Their rewards system is harder to game than eBucks, and in all likelihood you won’t be at the their top level. The bank accounts are almost carbon copies of FNB’s, and so is their rewards programme. FNB has Checkers, SB has PnP. FNB has Engen, UCount has Caltex. Standard also have some advantages, such as Young Professionals getting a private banker at roughly the same cost of FNB’s Premier account. I wouldn’t value this too highly though as, in my experience, their service is horrendous. Unless you are sure you will be on their highest level of UCount rewards programme, rather go to FNB. That said, if you are sure you can maximise your rewards, you can get some great value here. Also, if for some reason you value Diners Club highly, you can get their Platinum card bundled with your professional/private banking bundle.

I should note, however, that if you are interested in their Online Share Trading platform, you might benefit from the sign-up voucher you’ll get with SB’s private banking. You should note this isn’t the cheapest investment platform, so I wouldn’t sign up with this reasoning.

| Account | Fee | Min Income | Note |

|---|---|---|---|

| MyMo Plus | R110 | N/A | No credit card bundled. |

| Prestige Banking | R220 | R25k | |

| Professional Banking | R225 | N/A | Same features as Private Banking. |

| Private Banking | R380 | R58k | Diners Club Platinum fee included. |

| Signature Banking | R480 | R92k |

Absa. Similar to Standard Bank, Absa are likely not worth the effort. Their new app and online UX is great, but dealing with their branches is a pain - and you’ll likely have to do this for anything more complicated than opening a cheque account. I’ve heard they’re improving on their customer service front, and they seem to be trying hard to rebrand, but their reward system needs a lot of work. Absa themselves claim “you can earn as much as 1.15% on every swipe.” This doesn’t seem very high when you consider the effort it would take to maintain the highest reward tier. Unless you have an existing banking relationship with them, consider FNB instead.

| Account | Fee | Min Income (p/m) | Note |

|---|---|---|---|

| Gold Package | R129 | R4000 | Discounts under certain conditions. |

| Premium Package | R219 | R25000 | Discounts under certain conditions. |

As a special mention, Absa offer by far the best deal for students in the form of their Student Silver account. They give away both a fully featured cheque account and a matching low credit limit credit card to help build a credit score. Definitely a smart way to build a banking relationship while still a student, especially if you want the capabilities of a big bank as opposed to the newer players like Tymebank. For example, if you expect to be receiving or making some international payments, or want access to branches and ATMs. Not only are there zero fees, you even get some benefits like a R150 Travelstart voucher and some restaurant vouchers.

Nedbank Private Banking. Firstly, Nedbank’s GreenBacks reward system is not great for several reasons. Simply put, it isn’t that easy to maximise the value Nedbank says you can get. For example, you only earn rewards at full rate if using your NedBank AmericanExpress co-branded card. Even using the AmEx, you earn 4 GreenBacks per R10 spend. At redemption of 36GB:R1, that equates to about 1.11% reward. It is also not as transparent as FNB, SB or Absa.

With that said, they seem to offer the cheapest entry to private banking and don’t have any specific income requirements. Private banking here also gets you the American Express Platinum at half price for the first year, so this is the option if you want affordable private banking and/or won’t maximise eBucks. I’ll discuss the AmEx quirks and perks when considering credit cards in more detail, but the obvious problem is AmEx isn’t accepted at many businesses in South Africa. That said, pairing Nedbank with Woolworths Black could be cost-reward-effective.

Interestingly, Nedbank and AmEx offer some of the best international conversion fees at 2%. This certainly isn’t a major reason to go the Nedbank route, but could be important if you spend a lot of time/money out of the country.

| Account | Fee | Min Income | Note |

|---|---|---|---|

| Young Private Clients | R190 | N/A | Same features as Private Clients. |

| Savvy Bundle Platinum | R190 | ||

| Private Clients | R380 | ||

| Private Wealth | R468 |

Investec Private Banking. You’ll already know if this is for you. On the expensive side at R549, but you get what you pay for. Young professionals can access their suite at half the cost, but it might be harder to qualify for it in than with other banks. In terms of rewards and value adds, you get 1 point for R5 spend, and can transfer points on a 3:1 basis to Avios. The effective rewards rate when transferring to Avios is around 1.5%. With that said, if Avios is your aim, there are better options - AmEx and BA Card for example. Otherwise, its a more simple 1% reward rate on Travel by Investec where you get R250 for 5000 points. Simple and effective - and there’s no game to play.

To me, this makes the most sense if you have a portfolio of bespoke individual investments. Investec’s brokerage is quite pricey at around 1% minimum. With their service and international access, you can also arrange pretty much anything with them. Need access to swaps so that you won’t go over your SDA/FIA allowance? Want to write covered calls? This might be for you. Ultimately, this is the best option for HNWIs who value service and are global citizens.

Additionally, based on my limited interactions with the major banks, I would say Investec has the best talent pool. Clearly there is a respect for every aspect of the business, including UI/UX, software engineering, and customer service. For example, take a look at the programmable banking feature they offer in partnership with OfferZen - pretty cool, right?

Capitec Global One. Previously I would have argued that there is no reason to have a Capitec account as the rewards system was almost worthless. I didn’t see much use in having a Capitec account when you compare it to the likes of Tymebank and Bank Zero offering a free account and free essential features such as EFT payments. I also see more credit risk as compared to the other big players. With that said, the rewards system has slowly progressed such that it might make sense for some people. Firstly, there is no tiering system on their Live Better programme. There is also finally a reason to get a Capitec credit card as it boosts your rewards by 1% for a net reward of 1.5% - not bad for a low effort and seemingly uncapped system. As an honourable mention, the Capitec credit card actually offers a great minimum credit rate of 7.5% at time of writing. This is cheaper than many personal loans, so it might work out for you.

If you’re an EasyEquities investor, perhaps you’ll find some additional value in the minor discounts on EasyEquities trades through the Capitec app.

Digital Banks and Emerging Competitors

In this section I’ll discuss some of the emerging competitors to the big banks. There seem to be a couple of strategies that make this work. Either make the cost of onboarding a client extremely low and pass these fee savings onto customers (Bank Zero, TymeBank), or leverage your network effect and brand presence from existing business operations and lock clients into your ecosystem (Discovery).

Bank Zero. The place to be if you want no frills and no expense. The biggest surprise? Their 1% foreign currency conversion fee. That is less than half the cost most banks will charge, at around 2.5-3%. Because the only fee associated with opening this account is the cost of delivering the bank card, this could be a useful additional bank account for many people, even if you only really use it for travelling. I emphasise additional because this isn’t the bank for you if you want a line of credit in any form.

Another key benefit of Bank Zero is it is also completely free to use their account for business banking. This is a very strong selling point. There is also something to say about it being a mutual bank - one of a very select few in South Africa. But you never know, looking at you VBS.

Tymebank. Their GoalSave features pay some of the highest interest rates for savings accounts, but these are limited to R100k at time of writing. Since the rates are variable and increase to a maximum over time, you are also forced to keep your money locked into the GoalSave to maintain the interest rate. They do allow a fair number of these GoalSave account, so I would recommend splitting up your capital across the maximum number of accounts. That way, if you have to withdraw, you don’t lose the higher interest rate on all your capital. That said, if you don’t mind locking up your money, why wouldn’t you look at a higher yield fixed-deposit account?

Discovery Bank. As a special mention, I won’t be talking about Discovery Bank too much here. If you’re tied into the Discovery system then this might work out well for you. I do think most people overvalue the real return they get by being locked into the Discovery system. For example, you can run the calculations on their Vitality calculator. At the end of the day, the data they extract from you, the fact that you’re locked into their system, and how they do business just doesn’t appeal to me. Also, Vitality rewards seems to take up much more mental space than comparable systems at other banks. Keep in mind, to qualify for their high reward products you need to be of a high net worth.

There are good reasons medical professionals hate dealing with Discovery, and it’s up to you if you want to contribute to this. Don’t think they aren’t making more from you than you are from them. They have their pick of the smart actuaries and analysts. I’ll leave it at that.

On Credit and Charge Cards

Credit cards are a very interesting subject to study. As an indefinite line of credit, they are also useful tools in times when you need access to liquid capital - perhaps while you wait to withdraw from an investment. In some sense, the bank if “gifting” you the interest on your capital for a monthly service fee. Working out the cost-benefits of credit cards is extremely important, because those banking fees can add up very quickly. Don’t forget about all the hidden “facility” fees and “initiation” fees that come with most cards. So what should you keep in mind?

- Are you willing to play the rewards game? Some of these reward systems can be quite tedious, and to really make them worth it you’ll need to be at the top rewards “level”.

- Will you use points or does it make more sense to receive cashback?

- Is your “credit” card actually a credit card? Perhaps it is really a cheque account with an overdraft facility, or even a charge card. Does it need to be repaid in full each month?

- How many interest free days does it come with?

To understand how you’ll get the best deal, it makes sense to consider how credit card companies make money. Firstly, there are the obvious fees they make. These are mainly:

- Service and initiation fees.

- Interest on credit.

- Merchant fees.

But the real value comes at a deeper level. Why would Woolworths offer a credit card? Few companies understand customer behaviour better than the retailers, who specialise in behaviour. The real value lies in your data.

- Selling your data. Gotta read those T&C’s.

- Upselling and extracting value from your spending behaviour. Just like a loyalty programme.

- Locking you into the retailer by offering credit-linked incentives.

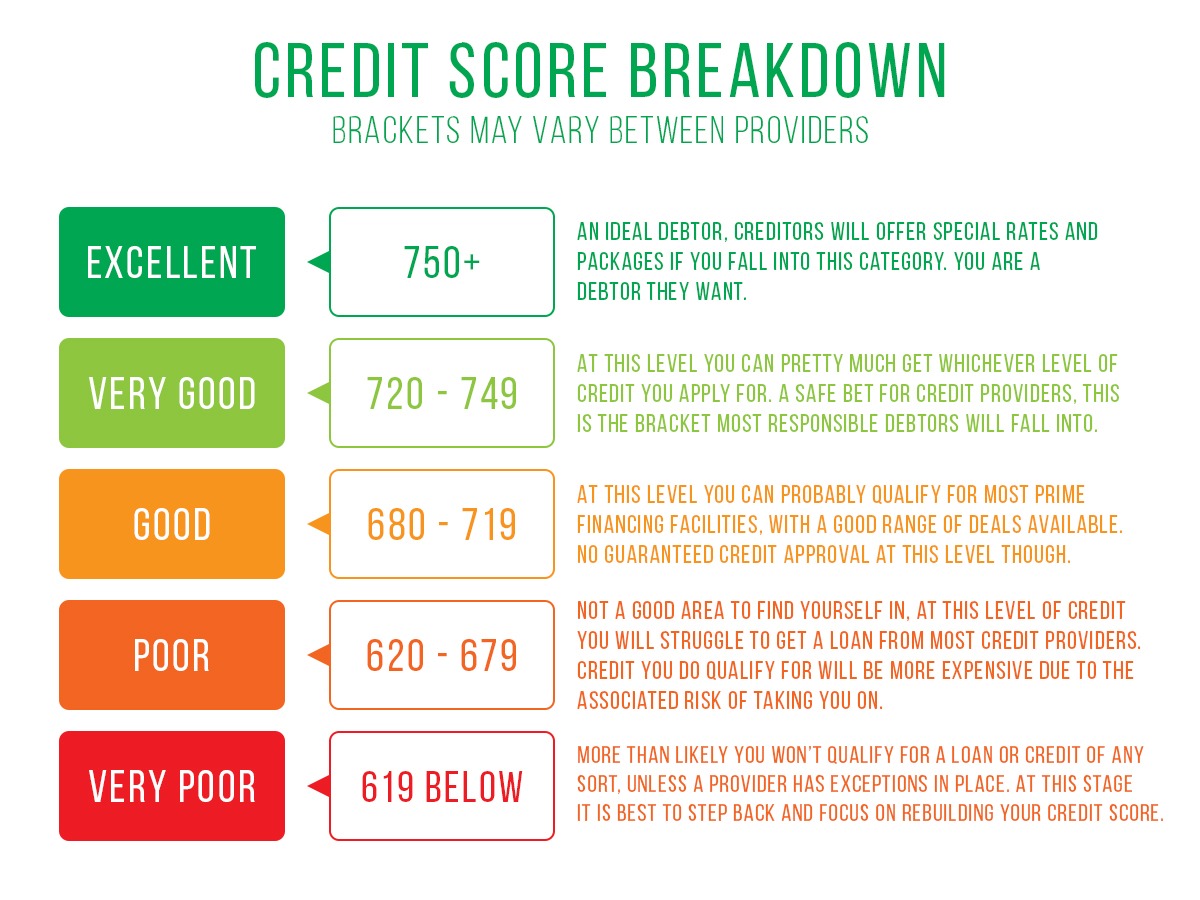

If you’re someone that cares about the interest rate on the credit card, you probably shouldn’t get a credit card at all. You really should avoid leaving an unpaid balance on your credit card. Not only will you have to pay an unsustainably high interest rate on your credit, you’ll also knock down your credit score. This will only send you into a deeper hole, where borrowing becomes more expensive and refinancing becomes even more difficult. Seriously, don’t touch credit if you’re someone who can’t handle the responsibility.

With that said, the full featured bank accounts mentioned above mostly come with credit cards included. I would never recommend paying extra for a conventional bank credit card because you can almost always get more value by using a reward focused credit card. We’ll now discuss some of the best of these reward cards.

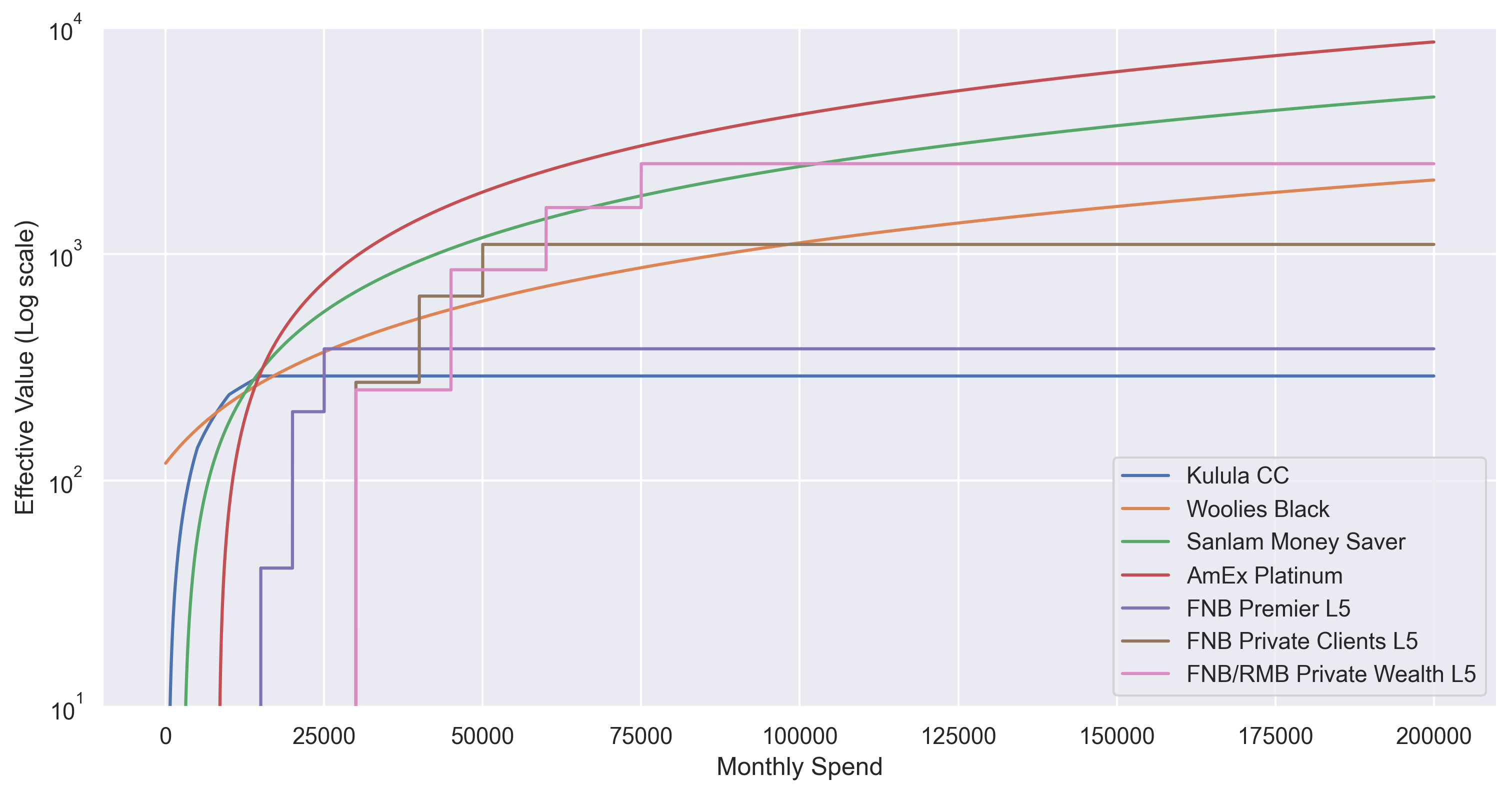

Woolworths Black. This should serve the basis for pretty much any maximum point strategy. What makes this so useful is you can pay the credit card off in store using another credit card! I’m not sure how long this loophole will last, but effectively you can do all your spending on your Woolworths card to get 1% back in Woolworths vouchers, and then pay off the account with another credit card to get spend rewards on that. Also comes with Visa Extended Warranty, travel insurance etc. As far as I know, Woolies accepts AmEx cards…do the math. Reading into the T&C’s, you’ll see you can’t pay off the Gold card in the same way. This makes it much less appealing because you can get better rewards with basic bank rewards such as FNB Smart Spend. If you wanted an additional line of credit, it’s still a useful card to have with a low cost of entry.

In many ways, the Woolworths facility is more of a bank account than a credit card. You can actually sign up for online banking and make payments. Seems like an indefinite money glitch…

Sanlam Money Saver. This is an RCS card (read: bad service) with banking handled by Mercantile. The card is a MasterCard, so no worries there. 1% cashback but 2.5% if you commit to matching the 2.5%. This totals 5% that gets added to an EasyEquities money-market fund. The fees on the fund itself are high, so take the shorter payout (i.e. quarterly) to minimise the capital in the account at any one time. If you want a simple and cost effective strategy for banking, get yourself a basic bank account and pair it with this card. Even better, get the Woolies Black and pay it off with the Sanlam Money Saver - an effective minimum 3.5% cash reward on every transaction you do. Just remember, this card needs to be repaid in full each month, so make sure you don’t forget this.

American Express Gold/Platinum. Perhaps the best rewards card available internationally, the value you could (in theory) get from these cards is amazing. The problem is AmEx charges merchants high fees for accepting transactions on their cards, meaning many small businesses will shun you for trying to use one. A key strategy would would be using the Woolies Black (Visa) card to do all your spending, paying it back with the AmEx for maximum reward. The problem is that locally, the AmEx Platinum is nothing like its international brethren. For example, whereas in the US you can exchange 1MR for 1 Avios, locally you can only get 1 Avios for every 3MR. When you realise this you really start to question what on Earth you get for the enormous intial and annual card fees…

Diners Club Platinum. Similar in strategy to the AmEx Platinum, this card focuses on value added services such as rewards and travel experiences. The problem is the reward rates are not even near the rewards you would get from using the AmEx card. With that said, it seems like you’ll have much more success using this card at merchants that accept Mastercard. After digging around, it seems you get 1 ClubMile for every R8 spent. This equates to about 0.72% redemption value.

British Airways Credit Card. A good option for those that want ot hop on the Avios train. The earn rate of one Avios for every R7.50 spent (or R5.00 spent at BA) is double that of the Investec points conversion route and slightly higher than the conversion you get from the local flavours of the AmEx Gold and Platinum cards. At a cost of R95pm and qualifying monthly income of R8000, this card is accessible as well.

Kulula.com Credit Card. A simple and cheap way to enter the credit card game, with monthly fees at R53.50. Perhaps even a great option for those trying to build a credit score without going the store card route because the qualifying salary requirement is relatively low at R6700 p/m. That said, the caps on the reward make it unappealing for everyday spending, and Kulula flights aren’t the cheapest option these days. Might be worth it for frequent travellers who value the 5kg free baggage allowance, but probably more of headache than anything.

Tymebank Credit Card. I really don’t like this credit card because the cost/reward tradeoff just isn’t in its favour. With that said, you can boost your Pick ‘n Pay SmartShopper points by using it.

Store Cards, Buy Now Pay Later & Loyalty Programmes

Credit in this form has existed for centuries - if not millennia. Simply put, they can be a great way to delay giving out your cash and making use of interest free features to leverage your cash to generate profits before paying it off. Be sure you are not tempted to increase your spending because of the attractive features, and always pay back your credit on time. They can also be the easiest way to start building a credit score, even for low income individuals. Be weary of monthly fees and make sure to abuse sign on vouchers!

- RCS Store Card

- Woolworths Store Card

- Cape Union Mart Store Card

- Game Store Card

- Payflex BNPL

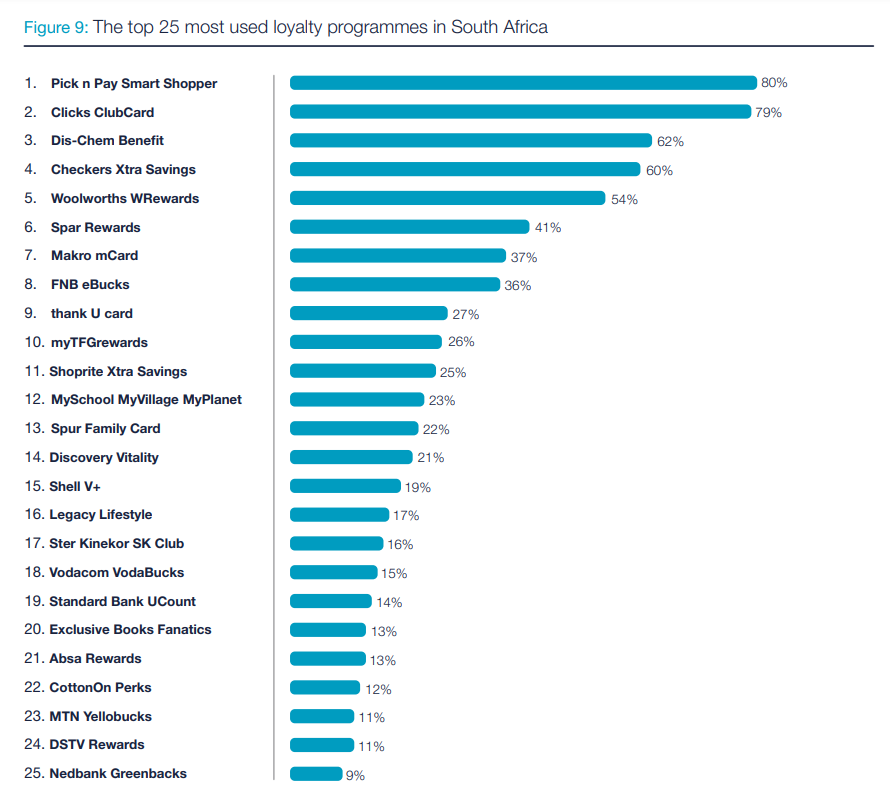

The much simpler way to get value back by being a “loyal” customer. What started as a way to retain customers is now much more than that. Every company is hungry for your data, so spend your privacy wisely. Take a look at this BusinessTech Article outlining the most popular loyalty programmes in South Africa. There are some good insights to be had.

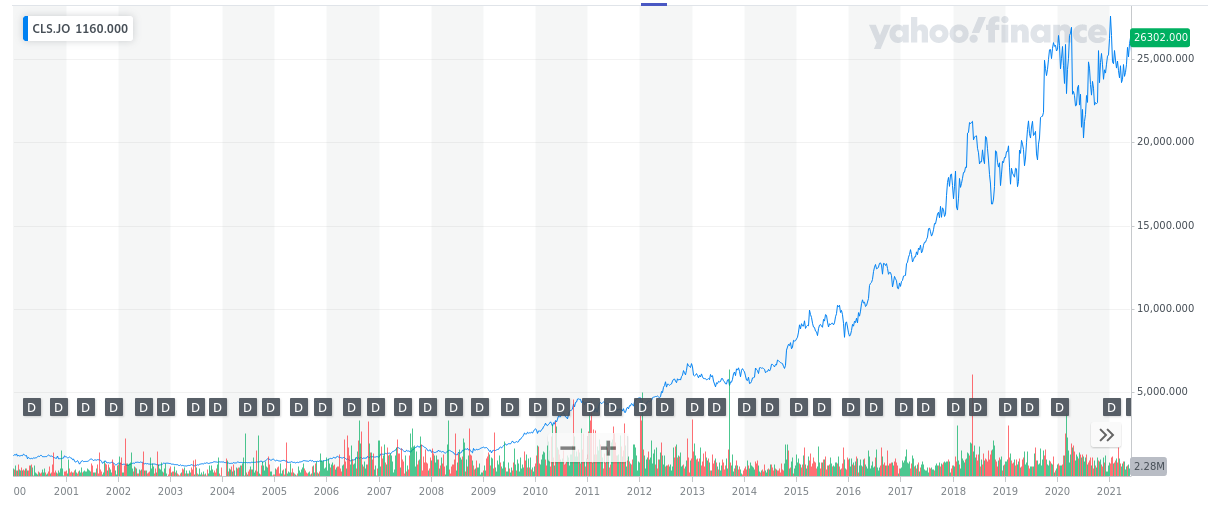

Clicks ClubCard. Perhaps the best loyalty programme in South Africa, Clicks Clubcard is a no brainer. Earning 1 points per R5 spend, at 10c per point, this works out to a reward rate of 2%. When spending over R1000 within 2 months, you start to earn at double reward rate (4%). This pairs extremely well with the FNB because at L5 eBucks, you could be earning up to 19% back on every purchase. Like FNB, Clicks is also partnered with Engen - further boosting your rewards.

Taking a look at the Clicks stock chart, it seems like they’re doing ok ;).

Dischem Benefit. As the major competitor to Clicks, its obvious why Dischem has a rewards programme. The reward system here is nice and simple - 1.5% back of purchase back in Benefit rewards on qualifying purchases. Not quite as rewarding as Clicks, but might work out better for you if you bank with Standard Bank, Absa, Discovery or Capitec.

PnP SmartShopper. Earning 1 point for every R2 spent at PnP, SmartShopper rewards equate to about 0.5%. SmartShopper is a sleeping giant of a rewards programme. In 2021, PnP claimed there was almost R200 million in unused points sitting unused! The key to SmartShopper points is to redeem them correctly for maximum value. For example, you can switch R40 of SmartShopper points for an R84 Ster Kinekor movie voucher (>1%). You could also swap R50 in SmartShopper points for a R200 Netflorist voucher (2%).

Checkers/Shoprite Xtra Savings. A very new player in the rewards space, Xtra Savings has stomped into the big boy room. Like Clicks, this pairs with FNB eBucks to give great rewards.

Bootleggers Coffee App. Alright, so this one is a bit random. I do love it - a work-friendly coffee chain that makes great food. Using their app yields a reward of 2%, with additional free coffee after 10 coffee purchases. If you’re more of a Mugg n Bean person, they have now have a carbon copy reward app. Likewise for Kauai, Seattle, Vida, Wimpy…hey, even the Cape Town Fish Market.

St John

St John